STOP OVERPAYING THE IRS

KEEP MORE OF WHAT YOU EARN WITH A PERSONALIZED 10X TAX STRATEGY

KEEP MORE OF WHAT YOU EARN WITH A PERSONALIZED 10X TAX STRATEGY

Included With The 10X TAX PLAN:

Tax Strategy Blueprint — Personalized, IRS-compliant tax plan with prioritized savings opportunities.

Discovery Call — Onboarding call with a Tax Expert to review income, entities, deductions, and goals.

Strategy Review Call — Guided walkthrough of your completed plan and implementation roadmap.

Strategy Summaries + IRS References — Plain-English explanations backed by IRS code for accurate execution.

Implementation Guides — Step-by-step instructions for each recommended strategy.

Document Templates — Ready-to-use agreements, logs, policies, and reimbursement templates for clean compliance.

TODAY 2x $2,500

Or One Time Payment Of: $4,997

Fill Out Your Information Below to Secure Now...

"If taxes are your biggest expense, then tax strategy needs to be your biggest priority"

- Grant Cardone

What’s Included In Your

10X TAX PLAN

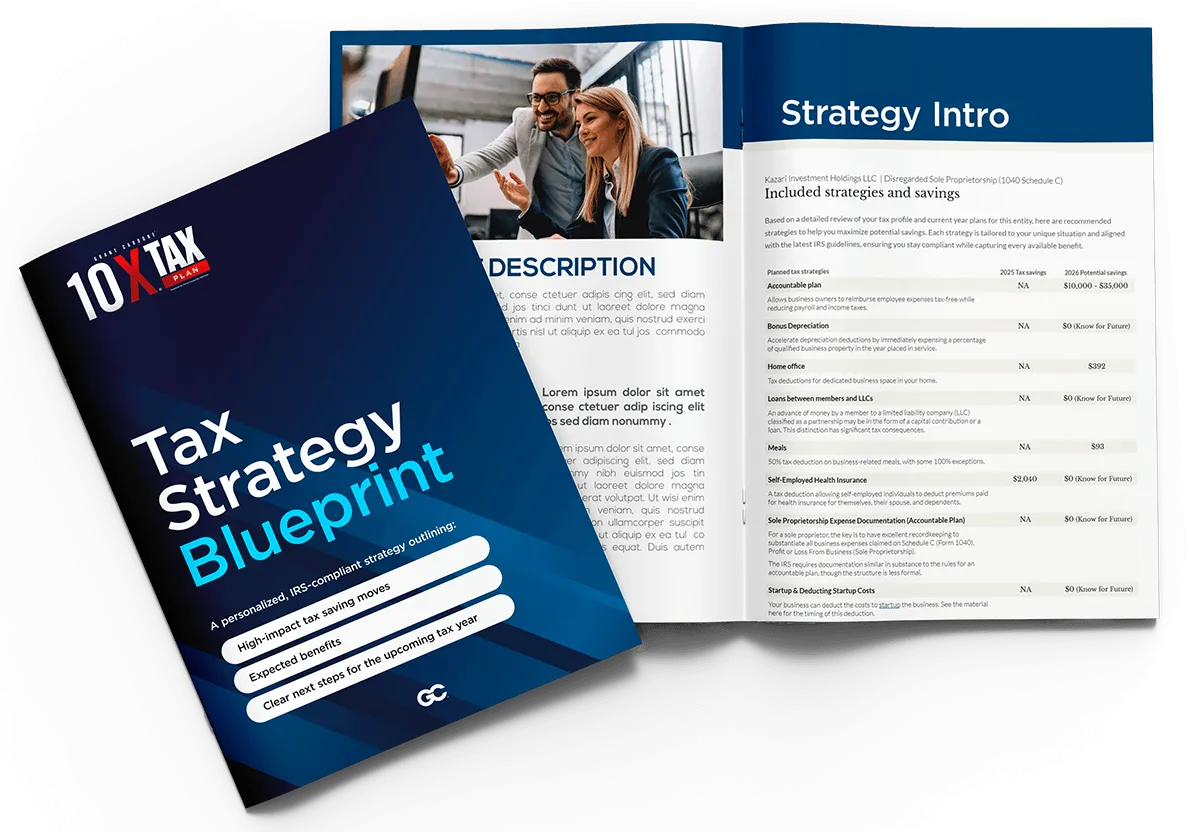

Tax Strategy Blueprint

Your Customized Roadmap to Legally Reduce Your Taxes

Identifies your top tax-saving opportunities for the upcoming year

Prioritized recommendations so you know what to implement first

Clear projected savings for each strategy

Built to match IRS rules so you can execute with confidence

Discovery Call With a Tax Expert

A Deep Dive Into Your Income, Entities, and Goals

Review of your current financial situation and tax structure

Identification of missed deductions you qualify for

Clarification of what you want to optimize or reduce

Sets the foundation for your personalized strategy blueprint

Strategy Review Call With a Tax Expert

Walk Through Your Plan and Know Exactly What to Do Next

Explanation of each strategy and why it applies to you

Step-by-step implementation order

Expected annual savings for every recommendation

Compliance notes so you avoid mistakes most business owners make

Strategy Descriptions + IRS Code References

Plain-English Breakdowns Backed by IRS Authority

Easy-to-understand explanations of complex tax strategies

Direct IRS code references for full accuracy and compliance

Helps you communicate clearly with your CPA

Eliminates guesswork in documentation and execution

Implementation Guides for Each Strategy

Execute Every Part of Your Plan Without Confusion

Detailed instructions on what actions to take

Exact documentation you need to maintain

Timeline guidance for when to implement each step

Ensures every move aligns with IRS requirements

Document Templates for Strategy Implementation

The Compliance Paperwork Done For You

Ready-to-use agreements, logs, and reimbursement forms

Built to IRS standards to support audits and reviews

Easy to customize for your business structure

Saves hours of administrative work and reduces CPA costs

TODAY 2x $2,500

Or One Time Payment Of: $4,997

At Cardone Enterprises we believe that success is the result of hard work, education and persistence. Examples given should not be considered typical and there is never a guarantee of results. Information provided is educational in nature and is not legal or financial advice. By using this website or any related materials you agree to take full responsibility for your own results, or lack thereof. Our team is here to support you, but you should always do your own due diligence before making any investment or taking any risk. Success is your duty, obligation and responsibility.

Cardone Training Technologies | 1-800-368-5771 | 18909 NE 29th Ave Aventura FL 33180

© Cardone Enterprises. All Rights Reserved.